Orient Watch Company: Holistic Analysis of Success, In-House Legacy, and Strategic Positioning in the 2023–2025 Market

- Cheap watches what a passion!

- Oct 17, 2025

- 12 min read

Updated: Oct 22, 2025

Brand Overview and the Japanese "Big Three" Context

Orient Watch Company holds a distinctive position in the Japanese watchmaking landscape, traditionally dominated by Seiko and Citizen. Although Orient is now an integral part of the Seiko Epson giant, it has maintained a firm identity that qualifies it as the only major Japanese manufacturer capable of offering high-quality in-house mechanical watchmaking at the most accessible price globally.

Its standing is unique: while Seiko is historically known for its mass innovations (from the first Japanese wristwatch to the world's first quartz watch) and Citizen has promoted Eco-Drive and quartz technology, Orient has assumed the role of custodian of pure Japanese mechanical tradition, successfully operating in the entry-level and mid-range price segments. This focus on internally produced mechanics (in-house calibers) is the bedrock of the brand's credibility and its competitive advantage.

The Value Proposition (V/P) and Dual Line Strategy

Orient's core philosophy centers on maximizing the Value/Price Ratio (V/P). The strategy involves integrating premium features—such as hacking (stop-seconds), hand-winding, and, in key models, sapphire crystal—at price points where direct competitors in the same bracket usually reserve for outsourced movements or lower specifications. This approach has allowed Orient to rapidly win over enthusiasts worldwide who seek the maximum tangible value for every dollar spent.

The brand is strategically segmented into two main lines to cover different target markets:

Orient (Standard): This line focuses on mass value and includes iconic models like the Bambino (dress watches) and the Mako and Kamasu divers. The goal is to provide robust reliability and appealing design using the F6 series in-house automatic calibers.

Orient Star: Launched in 1951, this line represents Orient's accessible high-end watchmaking division. It is nicknamed "The Golden Wing" and is characterized by attention to manual finishing, the use of more sophisticated calibers (F7/F8 series), and the introduction of complications (such as power reserve indicators or moon phases). Orient Star aims to compete in the segment immediately above the mass market, offering more refined watchmaking.

From Origins to Resilience: The History of Shogoro Yoshida

The Birth (1901) and Refoundation (1950)

Orient's history has deep roots dating back to the early 20th century. The founder, Shogoro Yoshida, established his first shop, the Yoshida Watch Shop, in Ueno, Taito, Tokyo, in 1901. Initially, Yoshida focused on selling imported watches, but production ambitions grew rapidly. By 1912, the company moved on to manufacturing gold watch cases, further expanding its business in 1934 to include the manufacture of wristwatches as Toyo Tokei Manufacturing.

World War II caused severe disruptions. The factory was destroyed in 1949, necessitating a refoundation. The current entity, Orient Watch Co., Ltd., was officially founded in Tokyo in 1950, initially restarting as Tama Keiki Co.. This refoundation symbolizes the remarkable corporate resilience in post-war Japan.

The First Major Watch and Orient Star (1951)

Although data does not provide the specific name of the first model produced after the 1950 refoundation, a chronologically crucial event occurred almost immediately: the launch of the premium sub-brand Orient Star in 1951. The timely launch of the premium line demonstrates a clearly defined strategic objective: the new company was not just aiming for mass production but sought to compete immediately in accessible mechanical high-end watchmaking.

This initial ambition, manifested by the creation of Orient Star, is a legitimizing factor for the brand's heritage and in-house identity today. It is not merely a manufacturer of inexpensive watches but a company that has historically maintained a focus on mechanical excellence , a strategically bold move during a period of economic reconstruction.

Overcoming the Quartz Crisis and Maintaining Mechanical Tradition

The maintenance of this mechanical tradition proved vital in the 1970s, when the global watch industry was swept by the quartz crisis. Unlike many competitors, Orient did not entirely convert to the new technology, maintaining its allegiance to the mechanical movement instead.

This resilience was supported by continuous internal innovation, as demonstrated by the introduction, as early as 1967, of the 3900 series caliber. This automatic movement was distinguished as the thinnest in the world at the time for a day-date display watch, reaching a thickness of only 3.9 mm. The ability to produce competitive mechanical complications before the crisis allowed Orient to weather the "quartz storm" while retaining credibility among mechanical enthusiasts.

The Evolution of Winding Power: The "Magic Lever"

A fundamental technical innovation that shaped Orient's reliability is the introduction, in 1971, of the Magic Lever winding mechanism. This proprietary, high-efficiency system is a crucial element of Orient mechanical watchmaking.

The Magic Lever replaced the previous L-type automatic movement and allowed for greater winding efficiency thanks to its compact and thin design. This winding mechanism has remained Orient's primary movement and, following its integration into the Epson Group, has been further improved in terms of finishing and precision. The Magic Lever is a symbol of Orient's proprietary mechanical engineering, ensuring reliability and long-term performance, and is the ancestor of the modern F6 calibers.

Corporate Structure and Strategic Synergies: Orient within the Seiko Epson Group

Current Ownership Structure

Orient is today a wholly-owned subsidiary of the Seiko Epson Corporation (EPSON). The acquisition was completed in 2009, consolidating Orient within the vast technology conglomerate. The control structure is rigorous: 100% ownership belongs to Epson, which also manages the global distribution of the brand outside the Japanese domestic market.

The size and financial stability of Epson, which reported a turnover of 9.5 billion euros in March 2023, guarantee Orient the necessary resources for continuous research and development of new movement series (such as the 46-F7 series for Orient Star).

Historical Context of Shares and Synergies

It is noteworthy that Orient has historically been a highly sought-after brand. Before the final acquisition by Epson, historical competitors Citizen and Seiko (as separate entities) had both previously held ownership shares in Orient. This fact underscores the strategic importance Orient has always represented in the Japanese watchmaking panorama, primarily due to its capability to produce quality in-house mechanical movements.

Despite the common ownership, Orient has maintained its identity and, crucially, its ability to produce unique mechanical movements that are not directly interchangeable with the calibers produced by Seiko. Although productive synergy with the parent company has led to a stylistic alignment, known as the "Jappo style," which sometimes makes Orient's design closer to Seiko's in recent years , mechanical differentiation remains key.

Brand Dualism and Strategic Segmentation

The Seiko Epson Group employs a market segmentation strategy that uses Orient not as a simple secondary brand, but as a controlled and targeted competitor, especially in the value segment. By keeping the movement production lines separate, the group ensures that the entire accessible Japanese mechanical watch market is covered, by both Seiko (with its 4Rxx calibers) and Orient (with its F6xx)

This internal competition is extremely advantageous for the consumer. The commitment to maintain Orient's in-house supply chain is a deliberate investment to offer a distinct mechanical value proposition. Orient is often pushed to include superior technical specifications—such as sapphire crystal on its affordable divers—to directly challenge Seiko and offer greater perceived and tangible value to the customer in the critical entry-level price segment.

The Technical Advantage: In-House Mechanical and Quartz Movements

In-House Philosophy: The Differentiation

Orient's ability to manufacture 100% of its mechanical calibers in-house is the foundation of its strategic success. This is a fundamental marketing point and a powerful catalyst for value perception. While luxury brands employ the in-house approach to justify high prices , Orient uses it to guarantee a high V/P ratio and mechanical credibility that producers relying on generic calibers cannot match.

Detailed Analysis of Automatic Mechanical Calibers (F6 Series and Orient Star)

Orient's current automatic movement range is based on the F6 series, a modern evolution of the design introduced with the Magic Lever in 1971. The F6 series introduced the modern mechanical features essential for today's market: hacking for precise time setting and hand-winding, making the movements more user-friendly than their predecessors.

Key calibers include:

Caliber F6922: Orient's standard movement for robust entry-level models, such as Mako and Kamasu. It operates at 21,600 vibrations per hour (VPH), has 22 jewels, and offers a typical power reserve of about 40 hours.

Caliber F6B22: Primarily used in the Classic and Field Watch lines, it integrates practical complications such as a Day of the Week indicator (often retrograde) and a 24-hour/Day-Night indicator, while maintaining the approximately 40-hour power reserve.

Caliber F6722: A base caliber with 22 jewels used in several standard models.

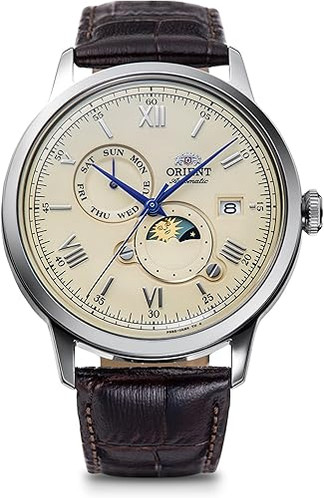

For the Orient Star line, more refined and higher-performance calibers are employed (F7 and F8 Series). These movements, such as the F6N43 and the 46-F7 series , almost always include a Power Reserve indicator on the dial, and often boast reserves exceeding 50 hours, in addition to benefiting from superior, and sometimes manual, aesthetic finishes.

Quartz Calibers

Although Orient's heart is mechanical, the company also offers quartz watches, primarily to cover fashion and retro design segments. A notable example is the solar chronograph Neo 70s Panda, which combines a sporty design reminiscent of the 1970s with modern solar quartz technology and 100-meter water resistance. This segment is important for brand diversification but remains secondary to the focus on mechanics.

Crucial Comparative Analysis: Orient F6922 vs. Seiko 4R36

The comparison between the Orient F6922 and Seiko 4R36 calibers is fundamental to understanding Orient's strategic positioning within the Epson Group. Both movements are automatic, operate at 21,600 VPH, offer about 40 hours of power reserve, and include hacking and hand-winding functionalities. Functionally, the two calibers are equivalent in the entry-level segment.

However, market and enthusiast community analysis reveals a significant distinction. Many experts and collectors believe that the Orient F6922 movement offers superior Quality Control (QC) and greater precision stability compared to the Seiko 4R36 in the most affordable price range.

This phenomenon is not accidental. While Seiko produces extraordinarily high volumes, allocating its 4R36 calibers to a vast range of products, Orient, while benefiting from Epson's economies of scale, appears to maintain more meticulous control over the tolerances of the F6 calibers intended for its value models. This perceived superior reliability positions Orient as the technically superior choice in a direct comparison of budget Japanese calibers and strengthens its reputation as an honest and reliable provider.

Iconic Models and Product Portfolio Segmentation

Orient's success is built on the presence of iconic models that dominate their respective market segments thanks to an excellent V/P ratio.

Orient Star: Artisan Excellence ("The Golden Wing")

Orient Star, launched in 1951, is the premium sub-brand and serves as Orient's technological and artisanal showcase. It is considered Orient's internal answer to accessible high-end watchmaking, similar to the relationship between Grand Seiko and standard Seiko. Orient Star watches are valued for their precision, often manual finishing of movement components, and elegant design. Skeleton models, the heir to the celebrated Mon Bijou from 1991 , and those with the power reserve indicator are central, demonstrating the brand's skill in complications.

Dive Watches: Robustness and Premium Specifications

The dive watch segment is crucial for Orient and has generated several bestsellers:

Orient Mako II: Considered a legendary diver and often compared to the discontinued Seiko SKX, the Mako II (41.5 mm, 200m WR) is a robust and reliable dive watch, powered by the F6922 movement. It has been a cornerstone of Orient's success in the US and Europe.

Orient Kamasu (Mako III/Ray III): This model represents Orient's best value proposition in the dive segment. The Kamasu is famous for the standard inclusion of a sapphire crystal, a feature that distinctly sets it apart from Seiko competitors in the same price bracket, which often use Hardlex mineral glass. This superior specification (sapphire, F6922, 200m WR) makes the Kamasu a primary choice among enthusiasts for its durability and unbeatable V/P.

King Diver Revival: Orient has skillfully leveraged its heritage with the re-edition of the Weekly Auto Orient King Diver (originally 1965-1968). This sports watch, large for its time (43mm), was re-released to celebrate the 70th anniversary, maintaining the super-compressor design (with a double crown) but upgrading specifications, such as 20 bar water resistance.

Dress Watches: The Orient Bambino

The Orient Bambino is perhaps the most widely known model to the general public and is universally acclaimed as the best automatic dress watch in the entry-level price range. Its success stems from its ability to offer an elegant aesthetic that "looks and feels like a watch five times its price" , thanks in particular to its distinctive domed mineral crystal.

The Importance of Sizing Adaptation

To maintain its relevance in the evolving market, Orient responded to the demand for more classic dress watch dimensions. The introduction of the 38mm Bambino model in 2023/2024 was a fundamental strategic step. This size, more in line with traditional dress watchmaking (36-37mm), offers greater versatility and has been highly favored by enthusiasts who perceived the previous 40mm models as too large.

Summary of Iconic Models and Their Market Role

Model | Segment | Typical Caliber | Distinguishing Feature | Market Role |

Bambino | Dress Watch | F6724/F6222 | Domed Crystal, Luxurious Aesthetic | "Value King", ideal watch for mechanical newcomers. |

Kamasu | Diver (200m) | F6922 | Standard Sapphire Crystal | Best specifications/price ratio in the dive segment. |

Orient Star | Higher-End/Complications | F7/F8 Series | Manual Finishing, Complications (Moon Phase, PR) | Showcase of Japanese artisanal excellence. |

Market Performance and Future Roadmap (2023–2025)

Identification of Continuous Bestsellers (2023–2024)

Despite continuous launches, the pillars of Orient's sales for the 2023-2024 period remained the models that define the brand's V/P ratio: the Kamasu dive watch (also available in popular variants like the Red ) and the Bambino dress watch. These models continue to be heavily promoted and recommended across watch channels, as they offer a complete technical package for the price.

Update and Refinement Strategy (2023–2024)

Orient's recent strategy, guided by the Epson Group, has focused on refining the portfolio to respond to market trends favoring smaller dimensions and more classic styles.

Sizing Reduction in Classic Line: New 38mm Classic and Simple Style models (AP01 and AC0M codes) were launched between September 2023 and April 2024. These watches, which include small seconds variants and subtle colors, reflect a targeted response to the demand for more elegant, versatile watches faithful to classic proportions.

Bambino Refinement: The focus on the 38mm Bambino, as discussed, solidifies the line as the ideal option for those seeking a traditional and refined dress watch.

Orient Star Proposals and the 2025 Roadmap

Investment in the premium segment is evident in the announced roadmap. An update is planned for the high-end Orient Star M45 F7 Mechanical Moon Phase model in September 2025. This continuous development of mechanical complications reinforces Orient Star's role as a brand offering technical excellence and sophisticated design, ensuring an upgrade path for enthusiasts who start with a Bambino or a Kamasu.

The Deep Reasons for the Brand's Success

Orient's sustained success is not attributable to a single factor but to a synergy of business strategy, mechanical heritage, and price positioning.

The In-House Factor as a Psychological and Economic Differentiator

The ability of Orient to manufacture 100% of its mechanical calibers in-house at such a competitive cost is Orient's main strategic asset. In a market where many similarly priced brands use standardized movements (such as the NH35 or Miyota 8215), the in-house approach grants Orient an aura of authenticity and watchmaking legitimacy. This attracts the discerning collector looking for true traditional mechanical watchmaking, not the assembly of external components.

The Irreplaceable Quality/Price Ratio (Q/P) and Competitive Advantage

Orient excels at offering technical specifications that surpass direct rivals in terms of raw value. The most blatant example is the Kamasu: the inclusion of sapphire crystal, which is notoriously more scratch-resistant than the mineral Hardlex glass often found in equivalent Seikos, is a tangible advantage for the consumer. This practice of over-delivering on specifications for the price paid has established Orient as the "new value king" in the accessible mechanical segment, especially after the overhaul of the Seiko SKX line.

Quality Control and Technical Reliability

Despite the close relationship with Seiko, Orient has developed a consolidated reputation, especially in the budget range, for having more uniform Quality Control (QC) and less variance in the precision of its F6 movements compared to the budget Seiko 4R36 calibers.

This perceived quality control advantage is structural: the Epson Group's investment in maintaining two distinct lines of in-house mechanical movements (Orient and Seiko) implies that Orient can focus on producing lower-volume calibers with perceived tighter tolerances. This intrinsic reliability strengthens consumer trust and reduces the risk of dissatisfaction, making Orient a secure purchase for both retailers and collectors.

Orient: The "Gateway Drug" to Watchmaking

Orient plays a crucial role in the watch ecosystem, acting as the first automatic purchase for many young and new enthusiasts. By offering a complete mechanical experience (in-house movement, hacking, hand-winding) in extremely desirable and robust designs (Bambino, Kamasu), Orient minimizes the barrier to entry into collecting. In this way, the brand not only generates immediate sales but also cultivates the next generation of enthusiasts, serving as a fundamental access point to the world of mechanical watchmaking.

Conclusions and Strategic Outlook

Positioning Summary

Orient Watch Company has solidified its position as the premier champion of value in the mechanical watch market. Backed by the financial strength of Seiko Epson, Orient has managed to preserve its in-house mechanical heritage and leverage it as a strategic differentiator. The brand's strength lies in its ability to offer feature-sets and technical specifications (like sapphire crystal in the Kamasu) that exceed market standards in its price segment, often surpassing direct competitors in terms of raw V/P and perceived Quality Control.

Future Prospects (2025+)

Orient's strategic direction for the 2023-2025 period highlights a focus on refinement and elevation of its value proposition. The introduction of 38mm models (Bambino and Classic Style) indicates an agile response to market trends toward more modest sizes. Concurrently, announced investments in the Orient Star line (such as the Moon Phase update in 2025 ) suggest that Orient is strategically aiming to offer a high-quality alternative for enthusiasts seeking an upgrade within the brand, maintaining its competitiveness even in accessible complications.

The brand's future success depends on maintaining the strategic separation of its F6 movements within the Epson Group. As long as Orient can continue to offer the in-house experience with superior QC and high-end specifications (like sapphire) at aggressive prices, its competitive advantage and its role as the "Gateway Drug" for mechanical newcomers will remain irreplaceable.

Strategic Recommendation

For B2B retailers, Orient represents not just a line of best-buy products but a brand with a strong growth trajectory and a loyal customer base. The Kamasu and Bambino are crucial for the acquisition of new customers in the automatic watch sector, ensuring a high satisfaction rate and promoting future purchases within the Seiko Epson Group portfolio. The company demonstrates a robust business model where in-house mechanical watchmaking is used as a tool for segmentation and V/P maximization, ensuring lasting structural value.

Other Brands on Amazon USA: https://en.orologieconomicimigliori.it/watch-brands-amazon

or have a look at these newest arrivals on Amazon USA:

Comments